News

Here Are 5 Things CBN Governor Said About Withdrawal Limit Policy That You Need To Know

-

The below are things CBN Governor Said about Withdrawal limit policy that you need to know.

THE NATION REPORTERS reports that the Central Bank of Nigeria (CBN) has said it will not be rigid about the cash withdrawal limit as it may tweak it as necessary since the intention is not to inflict pain on Nigerians.

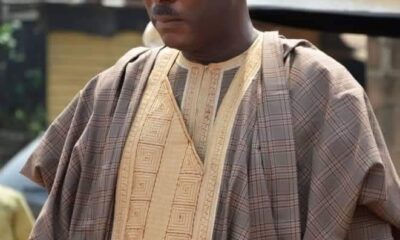

The CBN Governor, Mr Godwin Emefiele, who disclosed this on Thursday in a chat with newsmen after he visited President Muhammadu Buhari in Daura, Katsina State, said the President is strongly behind the policy on cash withdrawal limit and other measures recently enunciated by the apex bank and had told the apex bank not to worry about the reactions generated by the policy.

According to Emefiele, the CBN would review the withdrawal limit from time to time “to see how it is working because there is no rigidity; even though there will be no reversal of policy or change in timing.”

In pursuit of its cashless policy, the apex bank had on Tuesday pegged cash withdrawal at maximum of N100,000 and N500,000 per week for individuals and companies respectively.

Not unexpectedly, this has generated a flurry of reactions from different segments of society.

At his interaction with journalists on Thursday, the CBN governor also announced the commencement of the distribution of redesigned naira notes to Deposit Money Banks across the country.

He said the new currencies had reached the banks and the banks would soon start the distribution of same to members of the public who are their customers.

Emefiele had visited Buhari to assure the president that things were going on well about the currency as well as brief him on the economy, especially on issues relating to the newly introduced cashless policy.

Speaking further on the withdrawal limit, Emefiele said, “But whether it is about tweaking some amount to be a little bit higher or a little bit lower we will do so because we are human. We want to make sure that we make life good for our people.

“We can only continue to appeal to Nigerians to see this policy the way we have presented it. We do not want to make life difficult for them.

“There is no need for anybody to worry. The CBN is monitoring what is happening, and I am assuring everyone that we are alive to our responsibility and we will do what is right for Nigeria and Nigerians.”

On the position of Senate concerning the withdrawal limit, Emefiele said, “Well, the Senate of the Federal Republic is the legislative arm of the government and from time to time we brief them about what is happening and about our policies and I’m aware that they have asked for some briefings and we will brief them.

“But I think it’s important for me to say that the cashless policy started in 2012. But almost three to four occasions we had to step down the policy because we felt that there is a need for us to prepare ourselves and deepened our payment system infrastructure in Nigeria.

“Between 2012 and now 2022, almost about 10 years, we believe that a lot of electronic channels have been put in place that will aid people in conducting banking and financial service transactions in Nigeria.

“We heard about people talk about some of the people in the rural areas and the truth is that even online banking, as I was coming out to Daura, I saw a kiosk that has super agent today. It’s because of the way we felt that there was a need for us to deepen the payment system infrastructure.

“We have 1.4 million super agents that are all over different parts of the country, all local governments, and all villages in this country.

“And I have told my colleagues, some of their names are already on the CBN website and we will publish all the names of all the super agents. And having super agent which is different from the banks which is different from microfinance banks, which is different from other financial institutions.

“Having 1.4 million of them is as good as having 1.4 million banking points where people can conduct services.

“We think, Nigeria as a big country, the biggest economy in Africa that we need to leapfrog into the cashless economy. We cannot continue to allow a situation where over 85 per cent of the cash that is in circulation is outside the bank. More and more countries that are embracing digitization have gone into cashless.

“I said it at different fora that this is not targeted at anybody, it’s just meant for the good and development of the Nigerian economy and we can only continue to appeal to Nigerians to please see this policy the way we have presented it.”

Speaking on the amount of the old notes the apex bank has been able to mop up from circulation, he said: “We have taken more than half a trillion and in the bank we also have close to have a trillion.

“But what we have done in the central bank is to move more people from different departments into currency processing so that they can process this cash as quickly as possible and from there, banks can now move what they have with them.”

-

Breaking News3 years ago

Breaking News3 years agoBREAKING: CBN Redesigns Naira Notes

-

Breaking News2 years ago

Breaking News2 years agoBREAKING: Tinubu Considers Temporary Subsidy On Petrol

-

Breaking News2 years ago

Breaking News2 years agoJUST IN: Gbajabiamila Dies In UK

-

News3 years ago

News3 years agoDrama As Church Gives Certificate Of Virginity To Ladies After Testing Them (See Photos)

-

Crime4 years ago

Crime4 years agoUproar As Student Teacher On Teaching Practice Impregnates 24 Girls, Headmistress, Four Female Teachers

-

Breaking News10 months ago

Breaking News10 months agoJUST IN : Sacked Osun LG Chairman Killed Few Minutes After Returning To Office

-

Breaking News2 years ago

Breaking News2 years agoBREAKING: Dangote Speaks As BUA Reduces Price Of Cement

-

Crime3 years ago

Crime3 years agoJUST IN: Gunmen Storm Osogbo, Kill Man, Daughter Few Hours After His Wife Put To Bed (Photos)