News

Banks Run Out Of New Naira, Demand Soars

-

Banks have run out of new naira notes.

THE NATION REPORTERS reports that Mixed reactions greeted the disbursement of the new naira notes that officially went into circulation on Thursday with many bank customers demanding for the new notes while a few others snubbed the latest bills in banking halls across major Nigerian cities.

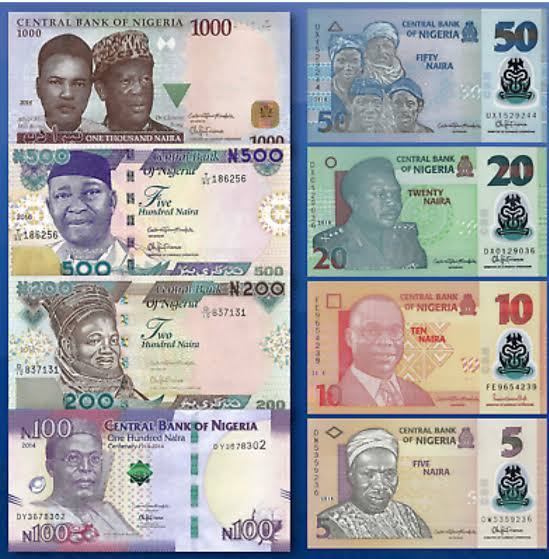

The newly redesigned N1,000, N500 and N200 bills finally became a legal tender on December 15, 2022, over three weeks after the President Muhammadu Buhari unveiled them at the weekly Federal Executive Council meeting.

The CBN Governor, Godwin Emefiele, had on October 26 announced plans to redesign the N200, N500 and N1,000 notes, while also declaring that the old denominations would cease to be a legal tender by January 31, 2022.

Emefiele stressed that the redesigning of the local currency became necessary to tackle inflationary problems, currency counterfeiting, insecurity and other issues plaguing Nigeria.

He further noted that the currency redesign was aimed at controlling currency-in-circulation as well as ransom payments to kidnappers and terrorists.

Our correspondents, who visited banking halls in several cities across the country, especially in Lagos and Abuja on Thursday, observed that several bank branches had run out of the small quantities of the new notes allocated to them from their head offices as early as 12 noon.

Further findings revealed that several bank branches were yet to get their new note allocations with many bank officials informing our correspondents that the new notes were still being expected.

In bank branches visited in Lagos, a number of the bank branches had run out of their new note allocations when our correspondents visited the places. However, officials at some of the centres which still had the new notes told The PUNCH their allocations were very small.

An official of Access Bank Plc at the Ojodu branch in Lagos, who spoke on condition of anonymity because he was not authorised to speak on the matter, said, “Each cashier was given N100,000 of the new N1,000 bill for onward disbursements to customers seeking over-the-counter payments. We don’t have the other denominations of N500 and N200 yet. We don’t have enough supply of the new notes for now.”

Also, our it was observed that the ATMs at the bank branch were dispensing only old naira notes.

Customers were also seen depositing the old bills over the counter, while cashiers were paying out more of the old naira notes at the centre.

However, in a few instances, the cashiers were seen mixing a few new naira notes with the old bills in their OTC payments.

Meanwhile, in some of the banking halls visited by our correspondents, some customers snubbed the new notes due to reports that some local traders were rejecting them as legal tender.

As such, some of the bank customers refused to collect the new notes for over-the-counter payments.

Confirming the situation, a bank teller in Ogba, Lagos told one of our correspondents that, “Some customers have been rejecting the new naira notes whenever we give them; they said the new notes would not be collected from them in the market; they prefer the old notes.”

At the bank, a cashier told a customer demanding the new notes she had exhausted her allocation.

However, when the customer insisted on having his payment in the new notes, the cashier approached his colleague to demand for some.

“You are eager to get the new notes but many of the customers I attended to today refused to take it from me,” the cashier said.

Abuja banks

In the Federal Capital Territory, Abuja, only one of the 10 bank branches visited paid their customers using the new notes. Also, only one of the ATM centre dispensed the new naira notes among the several ATM galleries visited by one of our reporters in the FCT.

Our correspondent visited the Guaranty Trust Bank, First Bank Plc, Zenith Bank Plc, Taj Bank and Access Bank Plc situated at Jabi Garage and the Central Business District.

None of the tellers in the bank branches was seen paying their customers in the new notes via the counters.

However, only the Access Bank ATM in the area was seen dispensing new N1,000 and N500 notes.

Our correspondent observed that the ATM dispensed N1,000 in every N10,000 withdrawal.

At GTBank, Jabi branch, our correspondent observed that the ATM dispensed old N1,000 notes to customers.

At the counter of the same bank, a bank official who declined to give her name told The PUNCH that the new notes were not available.

She said, “No, you can’t make cash withdrawals of the new notes. The best we can do for you is to mix the amount you are withdrawing with old notes.”

When our correspondent approached another official of the bank, she said OTC withdrawals were still being honoured in the old notes.

At the Zenith Bank, Jabi branch, an official asked our correspondent to come back on Friday or Monday for the new notes.

According to him, the new notes have yet to be distributed to the branch, adding they are hopeful it will get to the branch soon.

Our correspondent overheard a customer complaining of not being able to get the new notes despite withdrawing a huge sum of money at the branch.

A similar scenario was witnessed at the First Bank and Taj Bank branches as officials said the new notes were not available when our correspondent visited the centres.

At Taj Bank, an official who refused to give his name, claimed the lender was disbursing the new notes to customers over the counter but not at its ATM stand.

However, as of 3:45pm when our correspondent visited the branch, only old notes were being given to their customers.

Lagos banking halls

Also, during a visit to some banks in the Ikotun-Egbe and Isolo areas of Lagos, it was observed that the ATMs were dispensing old notes.

A customer at First Bank ATM in Ikotun-Egbe said, “The ATMs are still not dispensing the new currency here, what we still collect is the old ones.”

A Point of Sale terminal operator in Igando area, who simply identified himself as Chibuike, said he could not get the new notes when he visited his bank earlier in the day.

Also, when our correspondent visited the First Bank branch at Yaba, Lagos, the ATMs were still dispending the old notes.

It was also observed that OTC payments were being made using the old notes.

A bank customer Mr James Oni, told our correspondent he was anticipating to see the new notes, adding that he could not get it in the banking hall.

Also, when our correspondent visited the FCMB branch on Matthew Street, Yaba, only the old notes were being dispensed from the ATMs while OTC payments were also done using the old currency.

Meanwhile, our correspondent observed that several bank customers in Lagos and Ogun states could not access the new notes in their bank branches as of Thursday. However, others who were lucky got the new bills. Some customers expressed hope they would be able to see the new currencies in the coming days.

Emefiele for Reps

Meanwhile, CBN governor, Emefiele, will now on Tuesday appear before the House of Representatives to explain the new cash withdrawals policy of the apex bank.

The House was to grill Emefiele over the policy on Thursday but he failed to appear before the lawmakers.

The Deputy Governor, Corporate Services, CBN, Edward Adamu, in a communication to the House, told the lawmakers that Emefiele was part of Buhari’s entourage on an official trip to the United States.

The Deputy Speaker of the House, Ahmed Wase, read out the letter to members at the opening of plenary on Thursday.

The letter, with Reference Number GVD/DGC/CON/NAS/002/055, which was addressed to the Speaker, Femi Gbajabiamila, was dated December 13, 2022, and titled ‘Re-Invitation for a Briefing.’

After reading the letter, Wase said, “Colleagues, the Speaker has already rescheduled to Tuesday, December 20th for the CBN governor to appear.”

The House had last Thursday summoned Emefiele to come and explain the policy to the parliament.

The resolutions were based on a motion of urgent public importance moved by a member of the House, Aliyu Magaji, while another member, Ibrahim Olanrewaju, raised a point of order urging the chamber to demand suspension of the policy until the lawmakers conclude their investigation, a prayer that was unanimously granted.

Other members of the House also alleged that the CBN breached the Act establishing the apex bank, especially Section 5 and Section 8(4), by failing to brief the National Assembly before rolling out policies.

They also queried how the CBN funded that naira notes change, alleging a breach of Sections 80 and 83 of the 1999 Constitution which mandates all government bodies to spend only funds appropriated by the National Assembly.

Court declines assent

Meanwhile, Justice Sylvanus Oriji of a High Court of the Federal Capital Territory in Abuja has declined to grant a motion seeking to stop the new cash withdrawal policy of the CBN.

The application was brought before the court by 10 named applicants for themselves and on behalf of 20 million Nigerian citizens who do not use banks.

The PUNCH reported that although the decision by the court was taken on Tuesday, the court processes were obtained by journalists in Abuja on Thursday.

Buhari, Attorney-General of the Federation, Abubakar Malami and Emefiele were listed as respondents.

The applicants prayed the court to grant injunctions restraining the respondents from proceeding with the January 31, 2023 deadline for the use of the current N200, N500 and N1,000 notes as it affects the citizens without any realistic plans or workable guidelines to cover the over 20 million unbanked Nigerians who are vulnerable to information and the use of technologically driven platform without the possibility of financial inclusion.

They also prayed for an order restraining the CBN from the implementation of the revised cash withdrawal limits.

Furthermore, they asked the court to grant an order for accelerated hearing to the suit and also an order for substituted service on the parties while also praying for the order of court mandating the CBN to produce a detailed plan and guidelines covering the over 20 million unbanked citizens who are vulnerable to the use of telecommunication and technologically driven money platforms.

After listening to the counsel to the applicants, Justice Oriji declined the prayers for an injunction but rather directed that all the respondents be put on notice to come and show cause why the order for an injunction should not be granted against them.

The judge thereafter adjourned the matter to January 10, 2023, after granting orders for accelerated hearing and substituted service.

Source: Punch

-

Breaking News3 years ago

Breaking News3 years agoBREAKING: CBN Redesigns Naira Notes

-

Breaking News2 years ago

Breaking News2 years agoBREAKING: Tinubu Considers Temporary Subsidy On Petrol

-

Breaking News2 years ago

Breaking News2 years agoJUST IN: Gbajabiamila Dies In UK

-

News3 years ago

News3 years agoDrama As Church Gives Certificate Of Virginity To Ladies After Testing Them (See Photos)

-

Crime4 years ago

Crime4 years agoUproar As Student Teacher On Teaching Practice Impregnates 24 Girls, Headmistress, Four Female Teachers

-

Breaking News10 months ago

Breaking News10 months agoJUST IN : Sacked Osun LG Chairman Killed Few Minutes After Returning To Office

-

Breaking News2 years ago

Breaking News2 years agoBREAKING: Dangote Speaks As BUA Reduces Price Of Cement

-

Crime3 years ago

Crime3 years agoJUST IN: Gunmen Storm Osogbo, Kill Man, Daughter Few Hours After His Wife Put To Bed (Photos)